Working in executive search and as specialist of the Private Equity practice, I have had the pleasure of closely engaging with many private equity (PE) funds as well as their portfolio companies. That experience helps me understand better the emerging difficulties relating to executive talent and leadership in the PE industry.

Current Issues Regarding Executive Talent and Leadership in Private Equity

Mounting Costs of Acquisition Plus Increased Complexity:

- Market Forces: at about $2 trillion uninvested capital, PE firms are competing intensely for attractive targets, which has raised acquisition costs besides requiring more complex deal structures such as roll-ups that combine several small firms.

- Characteristics of Leaders: in this process leaders must know operational execution, but they also must know about change management as well as cultural integration.

Increasing Debt Costs:

- Financial Pressure: The world’s borrowing costs have increased considerably as interest rates have gone up. By way of illustration, the US Federal Reserve has lifted rates from almost nothing in early 2022 to above 5.25% at present. This has led to a two-fold increase in PE deal debt. With cheap money no longer an option, firms are now required to make progress in their operations if they are to keep up with returns.

- Concentrated Leadership: this financial pressure necessitates leaders who can drive efficiency and innovation simultaneously.

Longer Holding Periods:

- Extended Commitments: the shift from a typical five-year holding period to seven years or more means portfolio companies must exhibit continued operational excellence over a longer duration.

- Leadership Sustainability: quick wins are not enough for such leaders; rather they must develop capabilities that will ensure future growth and stability.

High Executive Turnover:

- Disruptive Turnover: high CEO turnover rates at portfolio companies make achieving expected returns difficult. More than 75% of CEOs are replaced post-acquisition often unexpectedly.

- Continuity in Leadership: continuity in leadership is critical for maintaining strategic direction and operational stability.

Conflicting Views on Leadership:

- Diverging Expectations: for instance, while the leaders in portfolio companies stress inspiration, motivation and team building, PE firms may prioritize cost-cutting and rapid execution.

- Concord: to bridge this gap, there needs to be an alignment of leadership expectations between PE investors and portfolio company executives.

Our Approach for Leadership Challenges

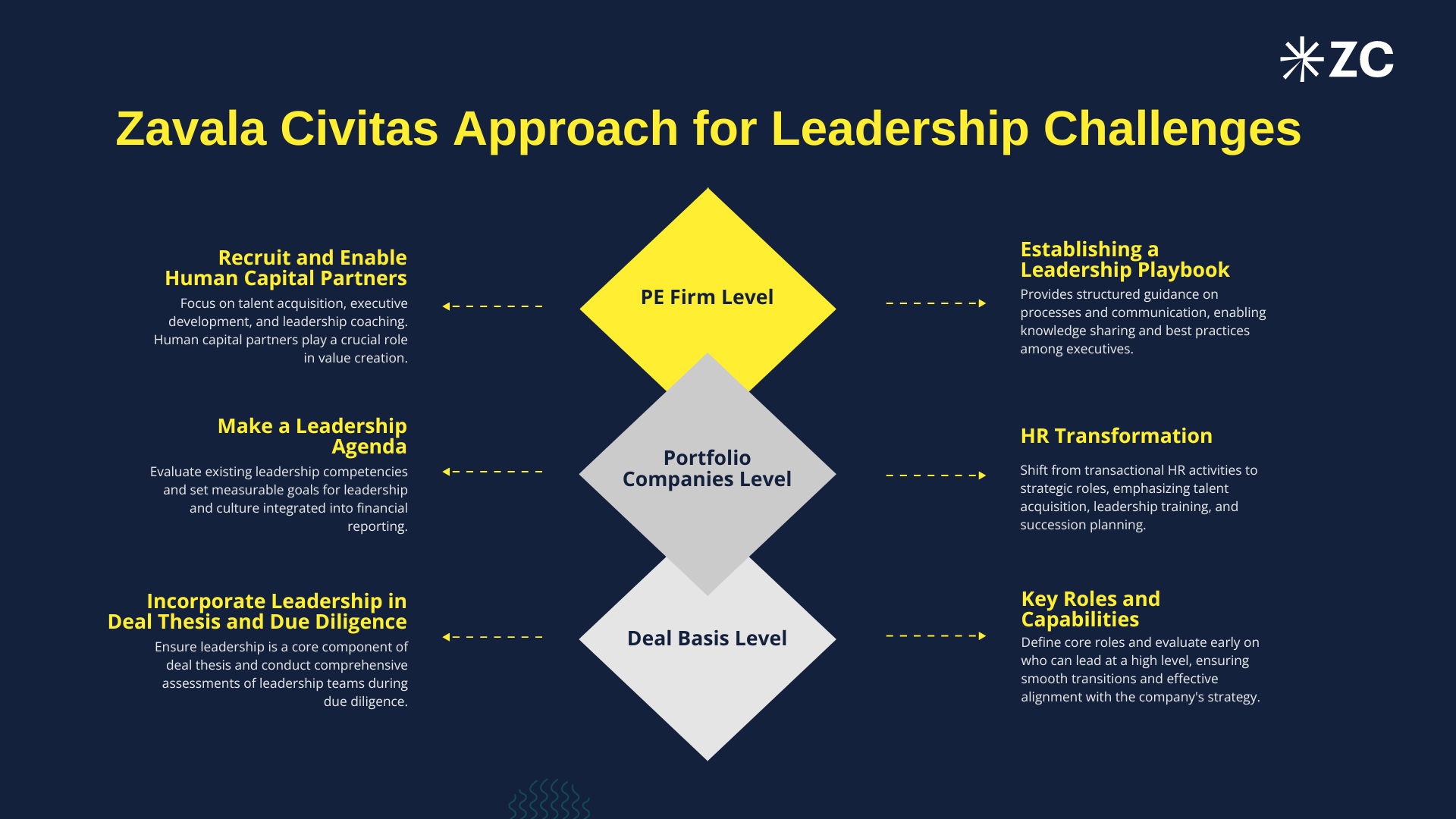

From experience, we in Zavala Civitas therefore offer a multi-faceted strategic approach to tackle these leadership challenges effectively. This strategy includes three levels: the firm that is PE based, individual deals as well as portfolio companies.

On the Level of PE Firm:

Recruit and Enable Human Capital Partners:

- Role of Human Capital Partners: 33% portfolio company executives that view talent strategy as a top priority when it comes to generating value. Indeed, we have seen how having dedicated human capital partners can revolutionize the operations within a private equity firm. These professionals concentrate on talent acquisition, executive development, and leadership coaching thereby ensuring that both the private equity firm and its portfolio companies possess the necessary leadership capabilities for value creation.

- Wide Role: as part of senior management team, human capital partners should have a broad mandate for talent improvement across their companies as well as those under them.

Establishing a Leadership Playbook:

- Guided Processes: a comprehensive leadership playbook can provide structured guidance on processes, expectations, communication patterns among others which will address key areas like evaluating talent in an organization or recruitment strategies are used by organizations or how they retain good managers to take over from old ones.

- Sharing Experience: this would enable the sharing of knowledge among company executives with knowledge being passed around through best practices at the firm level.

On the Level of Portfolio Companies:

Make a Leadership Agenda:

- Talent Management Strategies: portfolio companies must evaluate their existing leadership competencies and develop plans to enhance them. Subsequently, the plan should set measurable goals for leadership and culture that are integrated into the regular financial reporting to PE owners.

- HR Transformation: shift from transactional HR activities to strategic partner is key. This implies that low-value tasks will be outsourced to free up resources for high-value functions such as talent acquisition, leadership training, and succession planning.

Incorporate Leadership in the Deal Thesis and Due Diligence:

- Leadership Considerations: leadership ought to be one of the core components of any deal thesis by identifying management capabilities needed to realize intended value. Moreover, due diligence should include comprehensive assessments of leadership team and organizational effectiveness to ensure alignment with strategic objectives.

- Key Roles and Capabilities: defining core roles that create value and evaluating early on who can lead at a high level helps identify selectivity keep top performers while ensuring smooth transitions, effective alignment with company’s strategy.

For example, it happened that one of our clients, a private equity firm, bought a mid-sized manufacturing company with the aim of multiplying its turnover by 2 times over five years. After purchasing this company, we performed a deep assessment analysis of its leaders’ team which revealed serious gaps in their leadership abilities, mostly in strategic planning and talent development areas.

Actions Taken:

Human Capital Partner: to manage the transformation process towards the new management structure, PE Company appointed a dedicated human capital partner who dealt with all issues related to leadership changes within this organization.

Leadership Playbook: we created an elaborate manual explaining how we perform talent assessment within your company as well as recruitment processes for workers at different levels; coaching skills; monitoring progress against goals set during performance appraisal – all these features were used in constructing our ‘leadership playbook’.

Leadership Agenda: the portfolio company developed an all-encompassing leadership platform with specific objectives for enhancing employees’ motivation, attrition rate as well as the company’s management capabilities.

Due Diligence Integration: initial due diligence phase involved the identification of crucial leadership positions and linking them to the strategic goals of this organization.

Finally, within three years of its implementation, productivity increased by 40% and the rate of employees’ turnover fell by 30%. A strategic investment in leadership development significantly improved operational performance and set this firm up for a successful exit that valued it higher than expected earlier.

—————————————————-

I strongly believe that effective leadership among private equity firms has become paramount given the ever-changing business environment. To create lasting value, PE companies should come up with holistic strategies that combine investment and management processes with strong leadership practices to ensure resilient portfolio companies. In my day to day as an executive search consultant and organizational advisor, I have found that investing in learning leaders, aligning expectations around them, transforming HR practices are absolute requirements for accomplishing these objectives. This kind of strategy improves both operations efficiency and prepares firms properly at much better exit valuation, hence high profits for shareholders.

Bibliography:

https://hbr.org/2023/11/private-equity-needs-a-new-talent-strategy

https://www.commonfund.org/ The Rising Cost of Debt: Impact on Private Equity

AlixPartners’ Eighth Annual Private Equity Leadership Survey

Fernando Zavala

Mr. Zavala has +11 years of experience in the Americas, 12 years in Europe and 7 years in the Asia Pacific region. His career has been focused mainly on the HR industry. He launched the Zavala Civitas Executive Search’s office in both Shanghai and Barcelona. Before that, he founded IntuuChina, an award-winning placement agency in China. Graduated from the University of Otago in New Zealand he earned a full scholarship to Georgetown University for postgraduate studies.The Choiseul Institute recognized him as a high-potential young leader in Spain, and Nova Talent named him a top 10 Management Consultant in the country.